people's pension higher rate tax relief

You will automatically get tax relief at 20 on your pension but if you pay higher rate income tax its up to you to claim the rest. One of the issues with the pensions tax relief system is that many of the lowest earners who are not paying Income Tax in certain net pay workplace pension schemes are not receiving 20 tax relief on contributions.

Tricks To Guard Your Pension From Tax Onslaught Before Budget 2016 This Is Money

CuraDebt is a company that provides debt relief from Hollywood Florida.

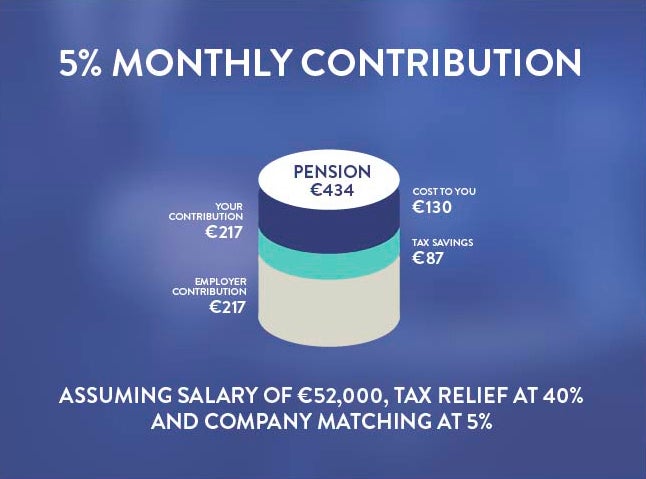

. Auto-enrolment in the expanding National Pension Scheme NPS will help as would raising the threshold for higher-rate tax. Therefore all your pension contributions are effectively increased by 25 per cent sic automatically because every 80 turns into 100. Pension Higher Rate Tax Relief.

CuraDebt is a company that provides debt relief from Hollywood Florida. Additional-rate taxpayers can claim 45 pension tax relief. Basic-rate taxpayers get 20 pension tax relief.

20 up to the amount of any income you. However if in any one year you have built up more than a certain amount in your. And it said even with changes made to reduce the cost of pensions tax relief the government was still likely to forgo around 31bn in tax revenues this year rising to 35bn in 2015-16.

Your scheme members who are Scottish taxpayers liable to Income Tax at the Scottish intermediate rate of 21 can claim the additional 1 relief due on some or all of their contributions above the. If an employee does not earn enough to pay Income Tax they can still receive tax relief on pension contributions. This means that for every 80p of pension contributions you make your basic rate band is extended by 1.

It was established in 2000 and has since become a member of the American Fair Credit Council the US Chamber of Commerce and accredited with the International Association of Professional Debt Arbitrators. In 2019 the threshold was. At that rate a 22-year-old earning 27000 paying 4pc in pension contributions would be 21000 better off by the time they reach state pension age according to Aegon a pension provider.

Anyone earning above that level pays 40 tax on a portion of their earnings. Understanding how higher and additional-rate tax relief is claimed can seem quite complex. But for higher and additional rate taxpayers this means they can shift some of their income out of 40 or 45 tax bracket and instead pay just 20 thereby receiving higher rate relief.

If you pay tax at 20 no further relief is due to you. Higher-rate taxpayers can claim 40 pension tax relief. Pension Higher Rate Tax Relief.

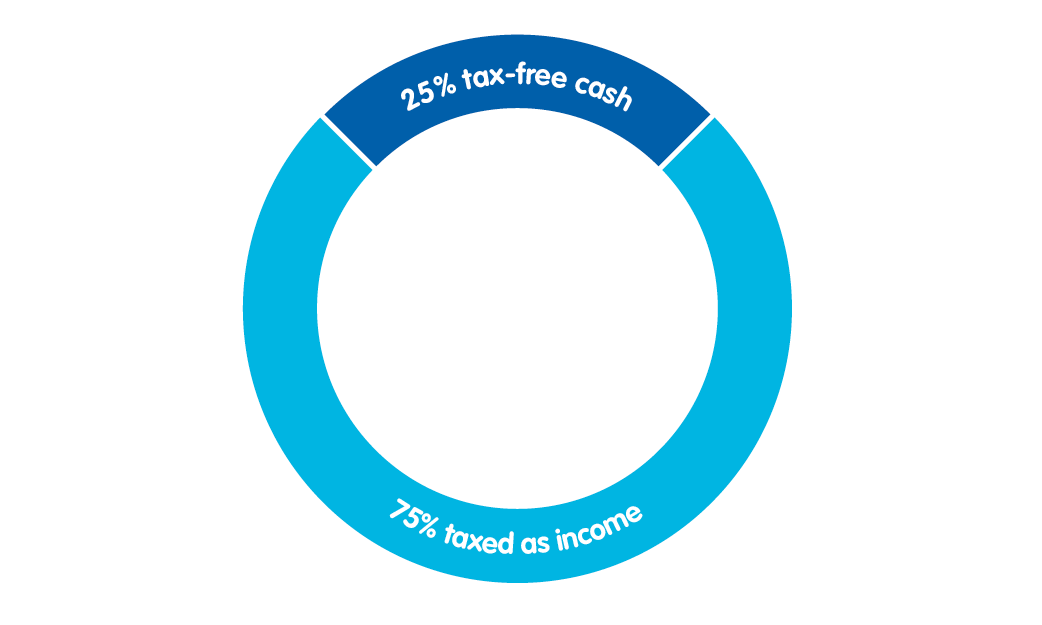

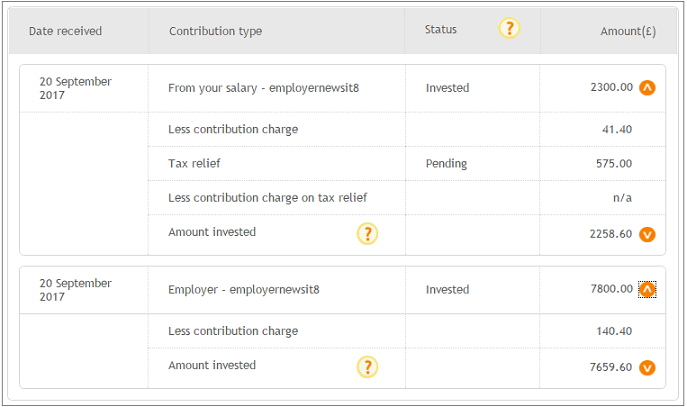

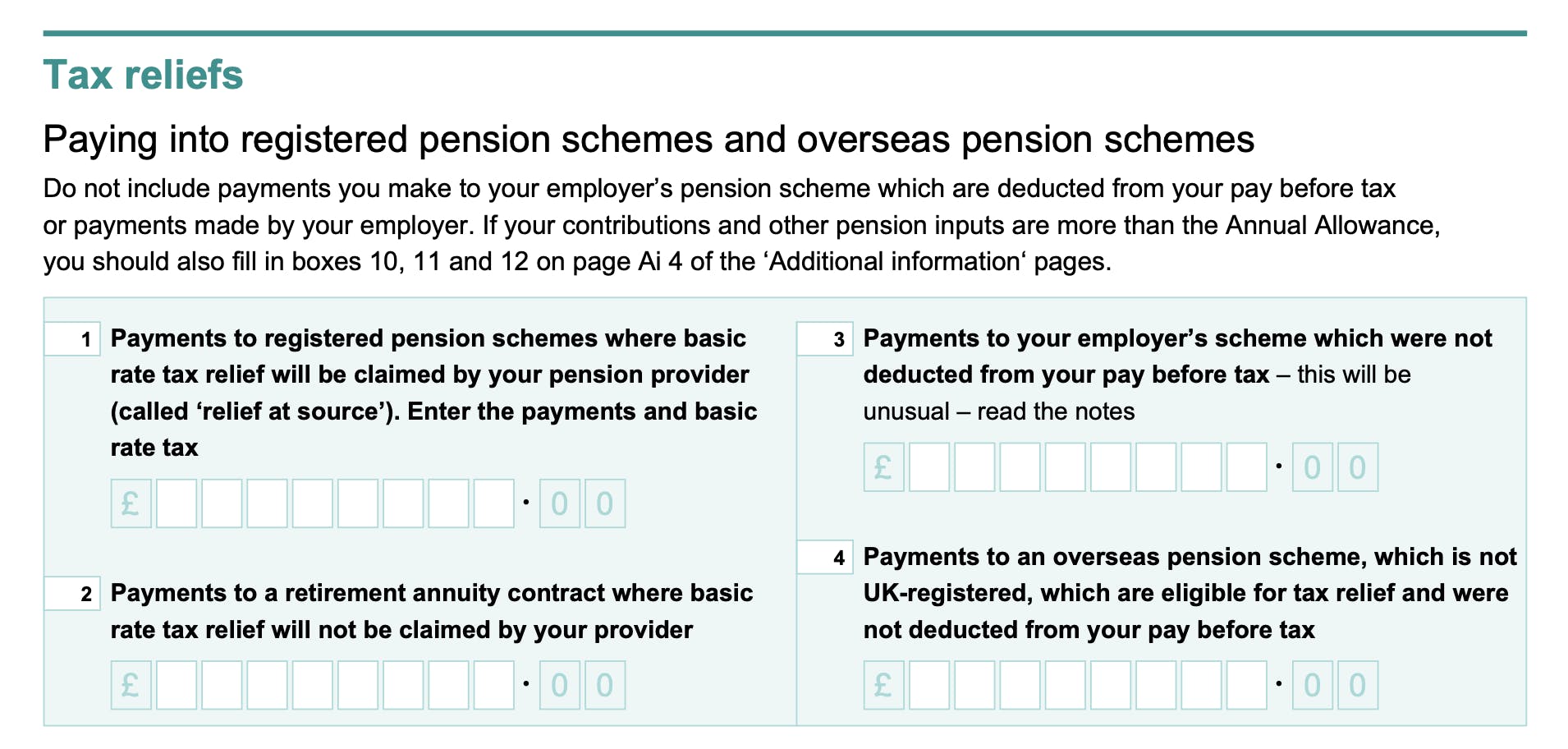

If youre an additional-rate taxpayer total income in excess of 150000 for current tax year 201920 you will only be able to claim the further 25 tax relief for your personal pension payments by submitting a self-assessment tax return. The Autumn Statement said that in 2010-11 tax relief for pension savings cost the Government around 33bn - with over half of this relief going to higher rate taxpayers. For every 80p you contribute to your Nest pension well claim 20p from the government on your behalf and add this extra money to your pension pot - if youre eligible.

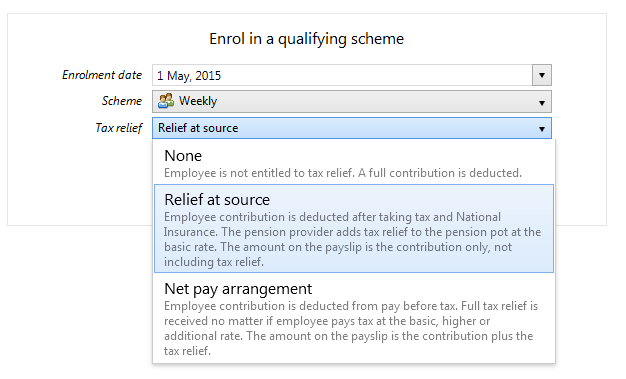

Higher-rate taxpayers who pay 40 per cent tax can currently claim back an additional 20 per cent via their self-assessment while top-rate taxpayers can claim an additional 25 per cent. About the Company Higher Rate Tax Relief Pensions. Relief at Source is usually considered fairer for lower paid workers.

About the Company Pension High Rate Tax Relief. The threshold for higher rate tax is 50270. You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of.

And youll find useful information on our website. Hi Im struggling to get my head round the tax relief on a company salary sacrifice pension when my salary is close to the higher rate tax band. The additional amount of tax relief you can claim is normally 20 of your contributions taking the.

One of the best things about saving into a workplace pension is tax relief. You can get tax relief on what you pay in up to 100 per cent of your earnings as long as youre under 75. You can find more information about tax relief on wwwgovuktax-on-your-private-pensionpension-tax-relief.

This is due to the way their pension scheme administers tax relief so they dont receive any Government top-ups. It was founded in 2000 and has been an active participant in the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators. Tax relief helps your pension grow.

Under a Net Pay Arrangement. The value of the tax relief to standard-rate taxpayers has come down. Tax relief is paid on your pension contributions at the highest rate of income tax you pay.

445 50 votes. The tax relief is currently available on contributions up to a maximum of 3600 per year or 100 of earnings whichever is greater.

How Do Pensions Work Moneybox Save And Invest

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased Co Uk

Workplace Pension Contributions The People S Pension

Pension Tax Tax Relief Lifetime Allowance The People S Pension

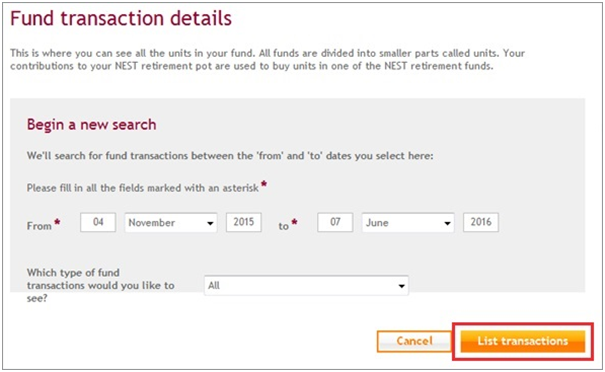

Do I Need To Claim Tax Relief Myself Nest Pensions

How To Claim Tax Relief Nest Pensions

Your Handy Guide To Company Pensions

Tax Relief Statistics December 2021 Gov Uk

Employee Tax Relief Brightpay Documentation

Q A Pension Automatic Enrolment International Reward

Pension Contributions And Tax Relief Nhs Employers

Q A Pension Automatic Enrolment International Reward

Sipp Tax Relief I How Sipp Tax Relief Works Interactive Investor

Invest In Nps Investing How To Plan Digital India

Employee Tax Relief Brightpay Documentation

How To Add Pension Contributions To Your Self Assessment Tax Return

60 Tax Relief On Pension Contributions Royal London For Advisers